DC Alternative Fuel Infrastructure Tax Credit for Residential EV Chargers

Last updated: August 28, 2025

DC Alternative Fuel Infrastructure Tax Credit is a state rebate program that covers most of District of Columbia. It provides incentives for installing an EV charger in a residential application. The program is run by DC Office of Tax and Revenue.

The program is currently open with an expected end date of December 31st 2026. However, keep in mind; the program may close sooner if its budget is depleted before the deadline.

What type of EV chargers does the rebate cover?

The rebate program covers Level 1, Level 2 and Level 3 chargers.

A Level 1 EV Charger plugs into a standard out in your home (120V) to juice up your car. Usually, a level one charger can add 2 to 3 miles to your car for each hour they're used. Most electric vehicles in the US will come with a Level 1 charger.

A Level 2 EV charger lets you charge up your electric vehicle much around five times faster. These chargers use 240V, or the type of outlet you see for an electric dryer or stovetop. They add between 12 and 60 miles to your battery each hour.

A Level 3 EV charger is the fastest type of EV charger. They're also called fast chargers, DCFC chargers, and DC fast chargers. These units typically use 400V or more and add 150 miles to a battery in an hour. They're not very common in residential applications at this point.

Learn more about the types of EV Chargers

How much is the rebate for EV charger installation?

The DC Alternative Fuel Infrastructure Tax Credit offers a rebate of $1,000 per station. The incentive may cover up to 50% of the project cost. Pre-approval may be required before installation, see the program documentation for full details.

What EV chargers qualify for this rebate?

Some rebate programs will only provide rebates for specific make and models of chargers. Other programs will allow any reputable brand/model, as long as it meets the technical requirements (such as being a Level 2 charger). Make sure to read all the program documentation before making any commitment to purchasing a charger.

Where can I learn more about the DC Alternative Fuel Infrastructure Tax Credit for EV chargers?

You can learn all the details for this rebate program at the link below.

Go to Program Website

What other rebates or incentives might be available for installing an EV charger in my home in territory?

There is 1 other program that might apply to you. See the details below.

Federal EV Charger Tax Credit

Federal Program

You may be eligible for a tax credit for installing an EV charger at your home.

See DetailsDo businesses qualify for this EV charger rebate?

Businesses, non-profits, and multi-family facilities are considered commercial accounts by many utilities. Commercial accounts have different rebate programs to use than residential accounts. Rebates4EVChargers only shows residential rebates.

Additional information

All about rebates for home EV chargers

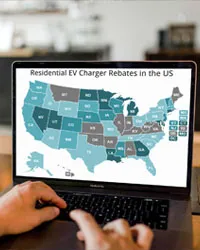

Roughly on third of the US has a rebate available for installing an EV charger in your home. That's on top of the Federal tax incentive that's available. Learn all about residential EV charger rebates.

Continue reading

Do I need an EV charger for my electric car?

One of the first things new owners think about when buying an electric car is how to charge it. Do you need to install a home EV charger? Learn how to make the decision.

Continue reading