The recently passed Inflation Reduction Act (IRA) has been making headlines over the past few weeks. While the legislation has been covered heavily in the media, most publications have glossed over the reinstatement of the tax credit for EVSE equipment. They instead focused on the tax credits for electric vehicles (EVs), increased funding for IRS enforcement and prescription drug cost caps. But this renewed incentive also presents a huge opportunity for anyone looking to install EV charging equipment. It extends and improves the previous tax credit available to businesses and residences.

Renewing The Previous Tax Credit

For the past few years, most businesses and homeowners who installed electric car chargers could file for a tax credit to help offset the cost. Congress extended the credit several times, but it was finally allowed to expire on December 31, 2021.

Since the beginning of the year, it has been unclear whether Congress would renew this credit for projects completed in 2022. With the passage of the IRA, the federal tax credit for EV chargers, commonly referred to as the 30C Tax Credit, has been extended until December 31, 2032. The rules have also changed slightly.

Federal Tax Credit for Homeowners Installing EV Chargers

Homeowners who install EV chargers on their property also qualify for a tax credit. The tax credit covers both hardware and installation costs. The credit remains the same under the new bill; 30% of the project costs up to $1,000. A big change, though, is that starting January 1, 2023, chargers must be installed in "approved census tracts" in order to qualify for the 30C tax credit. These tracts are typically low-income or non-urban areas.

According to the White House, these tracts cover approximately 2/3 of the Americans. While this new requirement went into effect January 1, 2023, the Department of Treasury did not release definitive guidance on what these approved tracts would be until January 19, 2024.

See the DOE's 30C Tax Credit Eligibility LocatorBusinesses Can Qualify For A Tax Credit Too

Businesses and other organizations that install EV chargers at their facilities can qualify for an incentive of up to 30% of the cost. With the passage of the IRA, the maximum amount of the tax credit has increased from $30,000 to $100,000 for projects completed after December 31, 2022. Projects completed before then would still be subject to the $30,000 cap.

The extension also has a few changes for installations completed after December 31, 2022. The credit now requires that projects pay the prevailing wage for labor and meet certain apprenticeship requirements. It also limits availability of tax credits to installations completed along approved "census tracts," typically low-income or non-urban areas.

How to get the Federal Tax Credit for EV Chargers

You claim the credit on your Federal tax return by completing form 8911 (see the form here). You can also review the guidance from the IRS at this site (IRS Guidance 8911) or consult your tax advisor. Unfortunately, these documents have not yet been updated to reflect the new legislation, but they should be in the near future. In the meantime, make sure to keep receipts for the equipment and installation of your EV charger.

Tax Credit Versus Tax Deduction

Many in the electrical distribution industry are familiar with tax incentives such as the 179D Tax Deduction for energy-efficient equipment. However, that was a tax deduction, which meant it was subject to the taxpayer's rate. This incentive is a tax credit. A tax credit is a dollar-for-dollar reduction of a customer's tax liability, so it has a much greater benefit to customers.

That means if you received a tax credit of $1,000, it would decrease the taxes you owe by $1,000. A tax deduction is subject to your tax rate. So if you received a tax deduction of $1,000 and fall into the 22% tax bracket, the deduction would save you $220. The bottom line is that a tax credit is usually much more valuable than a tax deduction.

Just the Tip of the Iceberg

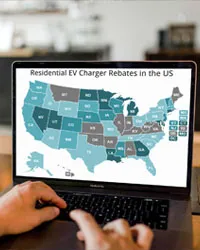

It's important to remember that the federal tax credit is just one of the incentives available for customers installing EVSE equipment. On top of that credit, customers may be eligible for rebates from their state, utility, county, regional organization or municipality. In fact, 63% of the country currently qualifies for a rebate for installing EV charging equipment. Use the tool below to see what kind of rebates and incentives may be available to you.